Fair Value

The Fair Value tab displays information in two key areas:

- Financials

- Audit Trails

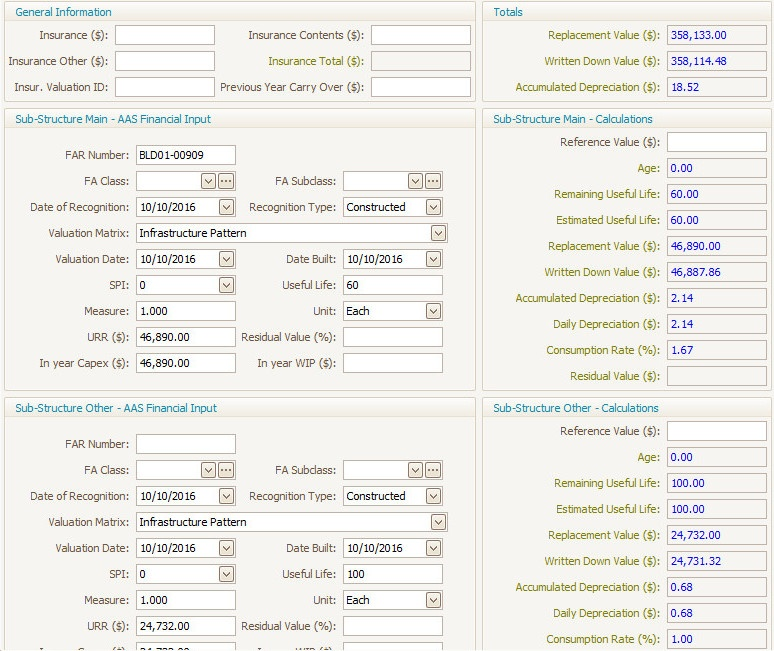

Financials:

The Financials section displays the information relevant to determining the 'Fair Value' valuation of an asset, such as the Date Built, Date of Recognition, Valuation Date, Service Potential Index (SPI), Unit Rate of Replacement (URR), In Year Work In Progress (WIP), In Year Capex, Residual Value and Useful Life.

Additional information is displayed or calculated depending on the asset category.

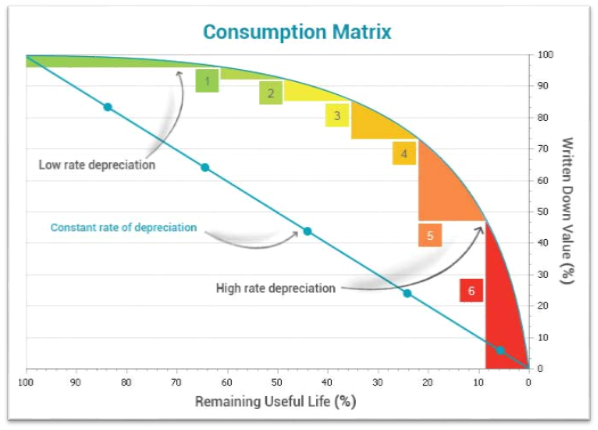

The system can handle and apply both a Consumption-based method of depreciation or an Age-based straight-line method of depreciation.

The consumption based method relies on prediction models that allow Users to assign remaining lives based on consumption profiles.

Consumption profiles are either:

-

Linear - Straight Line

-

Non Linear - Pattern of degradation

Whilst either method may be applicable, Users can choose based on AAS 116:

- Depreciation matches the pattern of consumption (AAS 116, Paragraph 60)

- Fair Value is based on replacement cost less residual (for general infrastructure assets) or market value (where there is evidence of an open and liquid market)

The figure below shows how the rate of depreciation changes as the asset moves from one state of consumption to another:

myData allows Users to set up:

- Valuation Matrices based on predicted paths of progression for the consumption method. Refer to the Predictor User's Guide to find out more about consumption patterns

- Remaining life profiles.

For information regarding setting up valuation matrices and remaining life profiles, refer to Set-Up Valuation Matrices.

All assets are broken down into respective components in line with AAS116 and again into Main and Other component in line with AAS13.

Break down of Buildings into different components

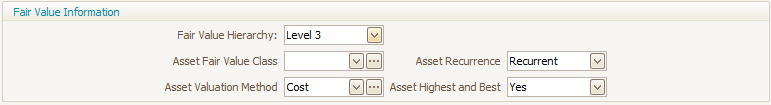

Fair Value Information (AASB Disclosures):

The Fair Value Information section is used to collect information pertaining to AAS13. Below is the screenshot with details:

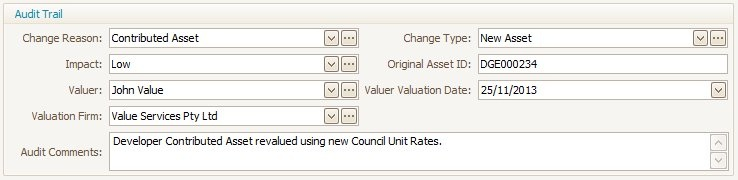

Audit Trail:

The audit trail section is used to track changes made to assets in a financial year period.

Users can set a range of criteria in the pick-lists for the audit trail, such as:

- Change reason

- Impact of change

- Valuer Information

- Audit Comments

This information may be updated when an asset is re-valued, upgraded, disposed of, or if key information such as unit rates or useful lives has a material change.

Audit Trail showing revaluation using appropriate new Council Unit Rate。

Detailed information about Fair Value tab and other related topics are covered in the Valuation Guide.